The Nobel-ity of Banks and Financial Sector Crises

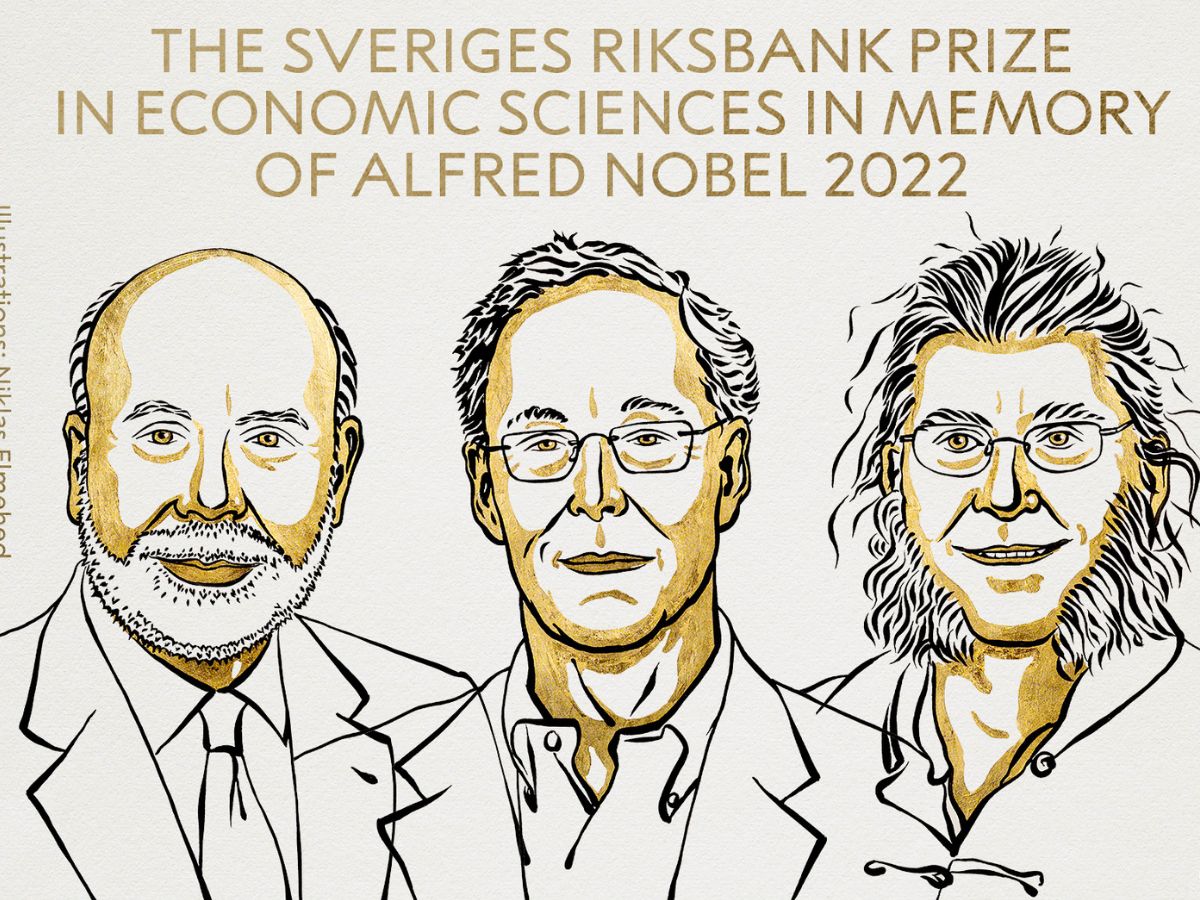

I suppose this now a tradition of mine as an Econ blogger is to comment on the winners of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022, Nobel Prize in Economics for short.

The winners are Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig, "for research on banks and financial crises." At least one of those names is notifiable, Ben Bernanke, the former chairman of the US Federal Reserve (2006-2014). Bernanke was in charge of the fed during the Great Recession 2007-2009 and oversaw the beginning of the economic recovery. Much of Bernanke's work was on the Great Depression. as a prime figure in our post-millennium economic world, he stands as one of the world's most influential economists today.

Diamond is the Merton H. Miller Distinguished Service Professor of Finance at the University of Chicago Booth School of Business. Diamond is considered a founder of modern banking theory. He is known for his research into financial intermediaries, financial crises, and liquidity; his research agenda for the past 40 years has been to explain what banks do, why they do it, and the consequences of these arrangements.

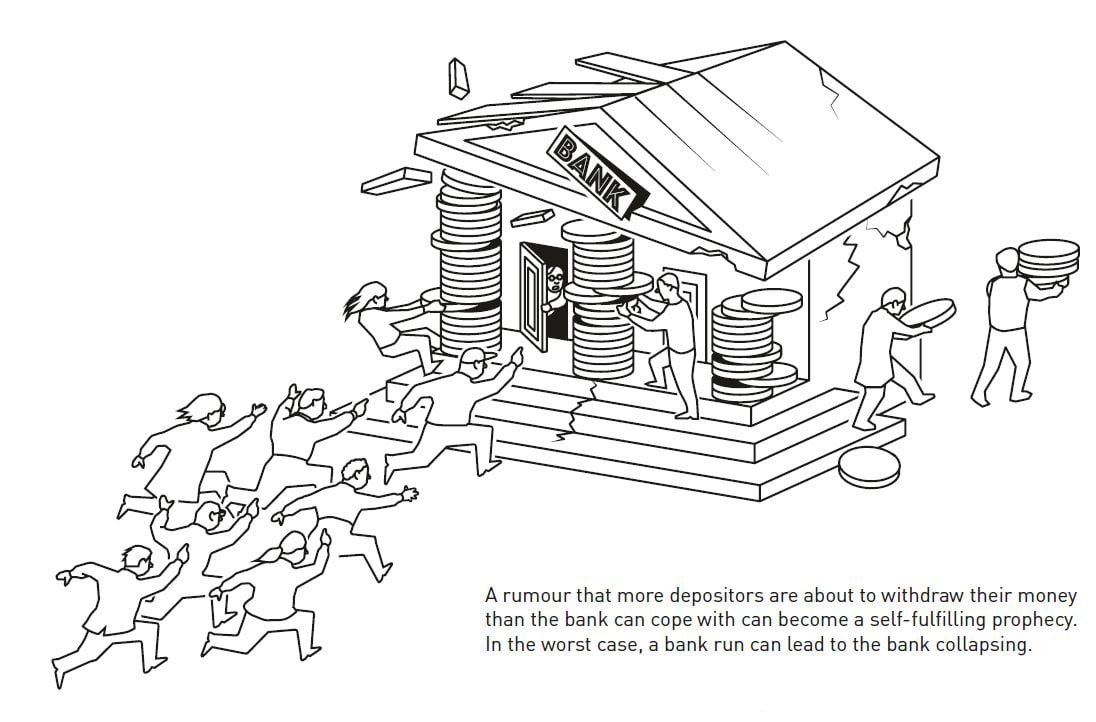

He and Dybvig later developed the Diamond-Dybvig model in "Bank Runs, Deposit Insurance, and Liquidity," which appeared in the Journal of Political Economy in 1983. The Diamond-Dybvig model demonstrates how banks specializing in creating liquid liabilities (deposits) to fund illiquid assets (such as business loans) may be unstable and give rise to bank runs. It shows how banks' outstanding liabilities, combined with illiquid assets, explain the role of banks, why they may be unstable, and why they may need a government safety net (such as deposit insurance) more than other borrowers.

The third equal prize winner is Dybvig; Philip H. Dybvig is the Boatmen's Bancshares Professor of Banking and Finance at the Olin Business School of Washington University in St. Louis. He specializes in Asset Pricing, Investments, and Corporate Governance. Dybvig is known for his work with Douglas Diamond on the Diamond–Dybvig model of Bank runs, which I mentioned earlier.

Now despite our personal feelings about banks, especially when it comes on to fees, interest rates, customer service, and other issues, we know more than ever that they serve a critical role in the economy to keep the proverbial wheels turning and their collapse is essentially rocket fuel to financial crises.

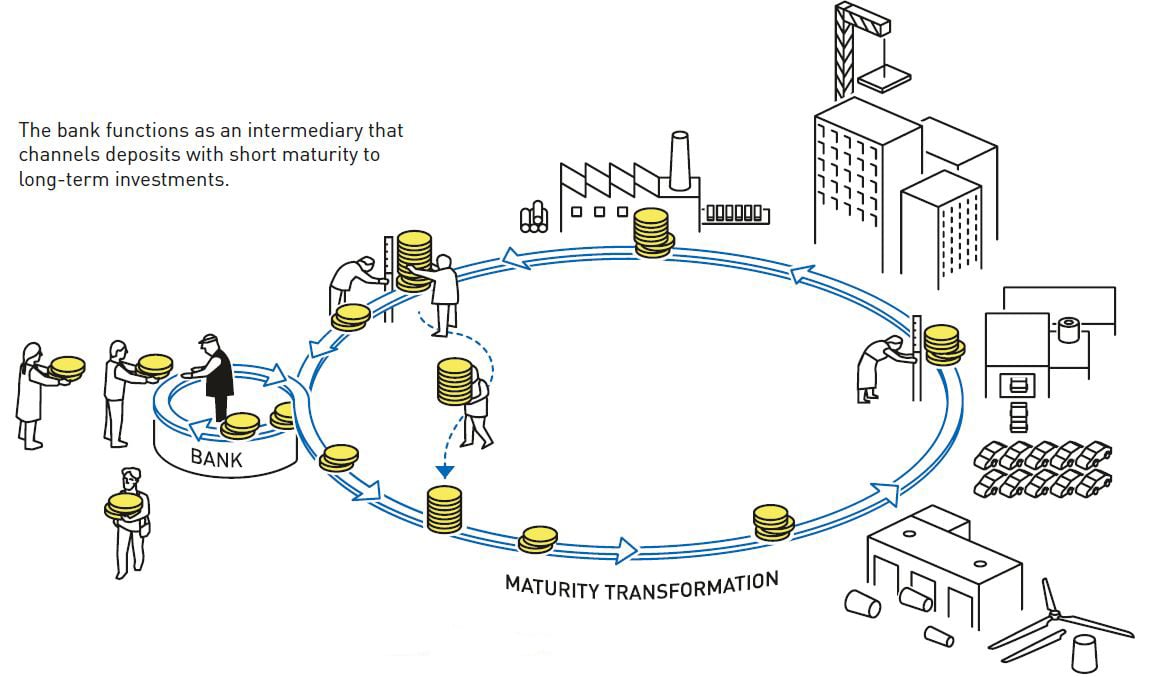

For the economy to function, savings must be channeled to investments, a function that banks facilitate. By acting as intermediaries accepting deposits from many savers, banks can allow depositors to access their money when they wish while offering long-term loans to borrowers.

But banks will still be vulnerable if all savers withdraw their money simultaneously. Banks are essential as they are better suited to assessing borrowers' creditworthiness and ensuring that loans are used for suitable investments.

The problem here is that banks are often more focused on profit preservation than their role as true financial intermediaries, especially in ensuring that private and small enterprises receive loan funding to grow.

This is because banks generally are more risk averse, mainly based on past experiences of significant financial sector collapses over the years in different jurisdictions. Hence, while we know and understand the ideal, a lot more work needs to make this critical function more efficient.

While we notice an increase in asset-backed consumer loans and unsecured personal loans, the rate at which loans are given for productive activities declines. Governments need to stimulate small and medium production, which we know has a more significant multiplier effect than the conventional trickle-down effects.

Comments

Post a Comment